News

iOS Devs See 40 Percent 2016 Revenue Jump As Store Wars Continue

- By David Ramel

- January 10, 2017

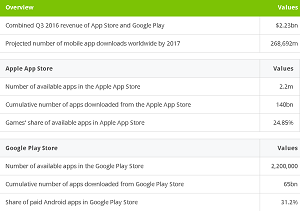

10 years after the debut of the iconic iPhone, Apple Inc. announced record revenue for its App Store and for iOS developers who created its 2.2 million app inventory.

"In 2016 alone, developers earned over $20 billion, up over 40 percent from 2015," Apple said in a news release last week. "Since the App Store launched in 2008, developers have earned over $60 billion, creating amazing app experiences for App Store customers across iPhone, iPad, Apple Watch, Apple TV and Mac. Those efforts helped kick off 2017 with a remarkable start, making New Year's Day the highest single day ever for the App Store with nearly $240 million in purchases."

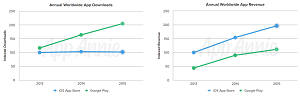

While no directly comparable numbers are available for the Google Play store and Android developers, iOS apps have traditionally generated more revenue for developers than Android apps, even though Google Play inventory usually surpasses App Store inventory in many reports and typically leads in the number of app downloads.

Such a report (for Q1 2016) was published in April, with Android Authority covering the news with a typical headline: "Report: Google Play Gets Double the Download Numbers as iOS but Brings in Half the Revenue."

Many more stats are available for the year 2015, and they're likely to mirror 2016's performance. For 2015, mobile metrics firm App Annie published a report indicating Google Play had twice as many app downloads as the App Store, but the Apple store enjoyed 75 percent more revenue.

[Click on image for larger view.]

2015 Downloads vs. Revenue (source: App Annie)

[Click on image for larger view.]

2015 Downloads vs. Revenue (source: App Annie)

"Once again we have proof that Google Play is bigger than Apple's App Store," said a Venture Beat article. "And once again we're learning that iOS developers, and thus Apple with its cut, tend to make more than Android developers and Google."

In another article covering 2015 statistics, Android Authority summed up the conventional view of the store rivalry: "Apple's App Store continues to generate more revenue than Google's Play Store for developers. The reasons behind this are interesting. The biggest is probably that Apple owners come from higher-income families. The handsets are expensive and these more affluent owners are prepared to spend more money on apps than the 'average' Android user."

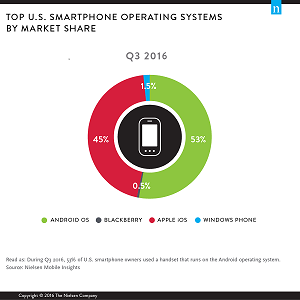

[Click on image for larger view.]

Q3 Market Share (source: The Nielsen Company)

[Click on image for larger view.]

Q3 Market Share (source: The Nielsen Company)

iOS developers enjoy a revenue advantage even though Android also has an 8 percent edge in the total market, according to statistics from Nielsen Mobile Insights for Q3 2016.

"In third-quarter 2016, a majority of subscribers used Android (53 percent) and iOS (45 percent) devices to access their apps," Nielsen said. "Two percent of U.S. smartphone owners used a handset that operated on a Windows phone, followed by 1 percent on a BlackBerry."

Research firm IDC in May summarized the statistics for 2015: "Apple's App Store 'ecosystem' captured nearly 58 percent of global direct app revenue in 2015, an increase of 36 percent year over year. Meanwhile, Apple's share of global app install volume was only 15 percent, down nearly 8 percent year over year.

"The sheer volume of Android-based devices in use ensures a greater overall number of installs through Google Play, which captured about 60 percent of install volume and nearly 36 percent of direct revenue in 2015. Although Google Play enjoyed solid year-over-year growth in both downloads and direct revenues, the gains were somewhat lower than in previous years. Apple is expected to continue outperforming Google Play in terms of revenue generation. However both ecosystems are more than sufficiently established to sustainably attract developers."

[Click on image for larger view.]

Store Overview Stats (source: Statista)

[Click on image for larger view.]

Store Overview Stats (source: Statista)

Also, both ecosystems are competing to sustainably attract those same developers, with increased developer guidance initiatives and more attractive slices of the app revenue pie. One strategy espoused by Google for mainstream app developers is to follow the gamer model for successful apps.

On the financial side of things, both app stores are wooing developers in many other ways, also. In June, Apple announced that the traditional 70/30 revenue split (70 percent to developers, 30 percent to Apple) would be increased to 85/15 after an app was subscribed to for one year. Google soon followed suit in announcing its own switch to an 85/15 split, without the one-year stipulation.

"While the new pricing structure is good for big businesses, like the film studios etc., it won't have any impact on indie developers or even on some of the big game studios," Android Authority wrote. "The transaction fee for in-app purchases and for the sale of apps remains the same at 70 percent/30 percent."

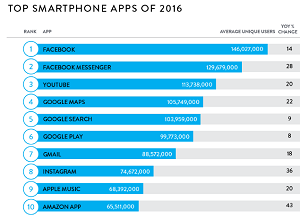

[Click on image for larger view.]

Top 2016 Apps (source: The Nielsen Company)

[Click on image for larger view.]

Top 2016 Apps (source: The Nielsen Company)

Both companies subsequently announced even more developer incentives, as Business Insider detailed in November:

- Apple announced that it will let developers provide in-app purchase promo codes for their apps and in-app purchases. These codes can be given (up to 1,000 for each app) for promotional purposes such as app reviews or news coverage, providing new publicity and recommendation opportunities.

- Google countered the move, announcing new subscription promos at reduced rates for limited periods of time, pre-registration for apps, better feedback via an Early Access program, app showcases and more.

- Google also made further moves, as reported by Time, which noted the company was expanding the store to accommodate new platforms -- such as wearable devices, virtual reality headsets and Chromebook laptops (from Google) -- and introducing machine learning to help improve app recommendations.

While mobile app developers now have a good understanding of app store dynamics and revenue opportunities (useful for plotting development strategies for the new year), IDC warned against assigning too much weight to all of the aforementioned statistics.

"While they provide a convenient measure of the mobile app economy and its beneficiaries, we caution that preoccupation with download/install volumes and associated direct revenue may miss the thrust of changes in the mobile marketplace," said IDC researcher John Jackson in commenting upon the aforementioned IDC report.

"Facebook and Google continue to dominate mobile ad spending thanks to the scale and sophistication of their network effects, with Facebook's moves to incorporate news and other interests into its experience will likely pull traffic and install volumes away from discreet apps. Similarly, the emergence of 'bots,' which seek to automate interactions in a contextually infused way, are another in a series of examples of value being created above the OS layer and even above the app."

All in all, the industry has evolved into a moneymaking machine few would have predicted when the iPhone debuted in 2007. For nostalgia's sake, here's a taste of ADTMag's coverage of the milestone event, written by John K. Waters, who was actually reporting from the CES show:

It is no small irony that the biggest buzz on Tuesday at the world's biggest consumer electronics show was generated by a device unveiled at another event about 500 miles away. Apple Computer's long-rumored and much-anticipated iPhone, finally launched at the Macworld Conference and Expo in San Francisco, all but eclipsed the stunning array of mobile devices on display this week at CES -- not to mention the big screen TVs, the smart-house systems, the digitally enhanced ATV, and just about everything else. For about a day, it was the talk of the conference.

Some 10 years on, it's still the talk of the town.