News

New Developer Surveys Show where Mobile Hotness Lies

- By David Ramel

- July 31, 2015

Web technologies are gaining back mobile developer mindshare, the Internet of Things (IoT) is coming on strong (though perhaps not matching the hype), the cloud is raining money, and the paid-download/advertising models should be scrapped in favor of in-app purchases to generate revenue.

Those are some of the takeaways from new mobile development surveys coming from VisionMobile Ltd., Red Hat Inc. and Strategy Analytics Inc. (with the participation of Sencha Inc.)

"Of all the technologies for building native or Web applications, HTML5 shows the strongest predicted growth at 20 percent," Sencha reported this week in announcing the 6th Annual Developer Survey conducted by Strategy Analytics (Note: this article originally said the survey was conducted by Sencha, but Sencha clarified that it was only a participant in the study). Sencha is a cross-platform Web app specialist.

VisionMobile, a market analysis and strategy firm, also pointed to strong HTML5 mindshare, especially among North American developers, in its State of The Developer Nation Q3 2015 report, also released this week.

"Across the developer community the most-popular development language is now a combination of JavaScript and HTML5," VisionMobile's Bill Ray said in a blog post yesterday. "The evolution of Web languages has imbued them with functionality, while cross-compilers and packaging tools can make them indistinguishable from native applications."

[Click on image for larger view.]

Where the Money Is (source: VisionMobile Ltd.)

[Click on image for larger view.]

Where the Money Is (source: VisionMobile Ltd.)

VisionMobile noted that North American developers are most interested in HTML5, being the primary choice of 47 percent of those developers. The company noted that North America has many highly skilled legacy developers familiar with HTML5 and JavaScript, eager to cash in on the exploding mobile marketplace.

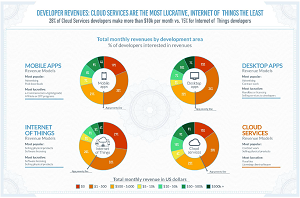

Speaking of cashing in, cloud developers are doing better than others in that regard, said the company, long known for pointing out how many developers counting on mobile apps for income are actually below the "poverty line," defined as making at least $500 per month.

"Cloud services developers have the best odds of making money," VisionMobile said, noting that 43 percent of respondents "interested in revenues" still fall below that poverty line.

And for those mobile developers interested in making money (which seemingly must be a vast majority), most (51 percent) are still below that poverty line, the company said.

"A major cause of this is that most of them still persist in trying to make money via the simplest revenue models to implement -- paid downloads and advertising," VisionMobile said. "We have repeatedly reported on the way paid downloads are not working for developers. The vast majority of revenue through the app stores has been via in-app purchases for some time now and the percentage keeps increasing."

Among enterprise developers, who don't have to worry about the poverty line, front-end skills are most in demand, according to a just-published Red Hat report titled The Enterprise Mobile Landscape 2015. The open source enterprise software specialist pointed out that organizations looking to hire this year are primarily looking for front-end developers (32 percent), followed by back-end developers (27 percent), with IoT -- though much hyped -- only coming in at fourth place (13 percent), just slightly ahead of "DevOps for mobile."

Red Hat sees growth ahead for IoT, however. "Most businesses are acknowledging the growing relationship between mobile and IoT by actively planning for the next wave of integration that will be required by connected devices," the company said. "While one in five organizations (21 percent) have already incorporated IoT projects into their business, a further 49 percent plan to incorporate IoT over the next five years."

VisionMobile agreed. "Mobile is still fairly new and developers are still figuring out the best ways to build software in that environment, but already we have massive interest in the IoT," the company said. That massive interest isn't paying off yet, however, as 59 percent of IoT developers earn less than $500 per month and 79 percent make less than $5,000 per month.

Other points of interest highlighted by the companies in the new batch of surveys include:

- Only 6 percent of VisionMobile respondents describe themselves as female.

- The most popular cloud development platform is decidedly private (targeted by 44 percent of VisionMobile respondents), ahead of Amazon Web Services Inc. (AWS) (16 percent) and Microsoft Azure (13 percent).

- Windows Phone is fading from view, VisionMobile concluded. Interest in Microsoft's mobile platform has declined in the last six months (from 30 percent to 27 percent), while Android is still the most-targeted mobile platform (71 percent) and iOS remains popular.

- The Swift language is growing, despite the fact that 16 percent of VisionMobile respondents working in Swift aren't earning any money at all.

- Mobile plays a role for 73 percent of organizations polled by Red Hat.

- Top challenges in mobile development among Red Hat respondents include security (48 percent), back-end integration (42 percent) and UI/UX (34 percent).

- 55 percent of organizations doing mobile development surveyed by Red Hat are coding their own custom back-end integration solutions.

- Smartphone devices continue to be a primary target, with 92 percent of developers supporting smartphone apps in the next year, the Strategy Analytics study conducted with the participation of Sencha said, followed by 84 percent supporting tablets and 36 percent supporting PCs.

The Red Hat survey of existing customers was conducted by TechValidate, which polled 120 organizations around the globe. VisionMobile's Developer Economics research program garnered more than 13,000 respondents from 149 countries in its new survey. The Strategy Analytics survey -- with the participation of Sencha -- polled more than 500 mobile app developers, including Sencha customers. The research firm didn't respond by press time to a request sent yesterday to obtain the full survey.

About the Author

David Ramel is an editor and writer at Converge 360.