News

Investor Advises Freemium Model for App Analytics Developers

- By David Ramel

- June 19, 2015

All kinds of advice is available for enterprise mobility strategies, but much of it comes with vendor bias. Weighing in on the issue from a more objective perspective is venture capital firm Emergence Capital, which studies the mobile ecosystem because it invests millions of dollars in the mobile ecosystem.

The company recently outlined some practical, real-world tips gained from interviewing more than 200 mobile players, such as advocating the freemium model for "mobile app enablers" that provide mobile app analytics SDKs.

"Once a mobile app has integrated one analytics SDK, the bar for ripping it out and replacing it with a competitor is very high," said company exec Joe Floyd in a contributed post on TechCrunch. "We have observed the most successful SDKs like Mixpanel have targeted developers early with freemium offerings. Consequently, we have observed that getting your SDK distributed widely with freemium has enabled early leaders like Flurry to evolve their product offerings into other areas."

Mobile enablers are defined as companies that provide SDKs, APIs and development platforms to help organizations create, market and monetize mobile apps.

Mobile app SDK makers need to fight for mindshare, Floyd said, because "mobile app developers are simply not willing to integrate an infinite number of SDKs" in the mobile arena, which has longer development cycles than Web app counterparts and features devices with limited storage and capabilities compared to other platforms.

The freemium model, Emergence Capital has observed, helps mobile enablers fight for that mindshare.

The investment firm also addressed the Web vs. native development approaches, noting that established leaders in the Web arena don't necessarily hold that position in the mobile app world.

"Mobile app development is fundamentally different from Web app development -- from the programming languages to the hardware resources available to run an app and ultimately to the app store distribution model," Floyd said. "As a result, Web app technology incumbents do not have an advantage in most categories."

New leaders have come forth to solve mobile-specific problems, he said, offering app testing specialist Crittercism as an example of a mobile-centric company that emerged to solve specific problems stemming from the explosion of mobile devices.

"With app stores serving as the gateway for user acquisition and monetization, we found that startups like App Annie (app store data) and ZenMarketing (attribution) started to solve very specific needs that their Web counterparts like comScore and Convertro were not solving," Floyd said.

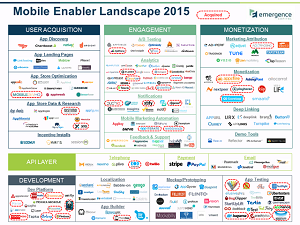

The company provided an infographic breaking out the mobile landscape into three catgegories: technologies that accelerate app development; the API layer used in mobile apps for connecting to cloud-based services; and the sales and marketing technology layer driving user acquisition, engagement and monetization.

[Click on image for larger view.]

Summing it All Up (source: Emergence Capital)

[Click on image for larger view.]

Summing it All Up (source: Emergence Capital)

Along with the need for mobile SDKs to fight for mindshare and the native vs. Web leadership issue, Emergence Capital provided a final insight: point solutions are evolving into suite. It noted that Leanplum and Swrve evolved from simple A/B testing to offer more services, Mixpanel expanded from analytics into marketing automation, and Kahuna and Appboy moved on from only mobile marketing automation to e-mail marketing, usurping some Web incumbents in the process.

"As we look ahead, we know the number of mobile enterprise apps will continue to grow and this will benefit the ecosystem of enabling technologies," Floyd said. "However, as enabling technologies mature, competition will increase -- both from other startups and from the Web incumbents who rapidly attempt to catch up. We anticipate consolidation within the major categories on our landscape, particularly as the early leaders broaden their capabilities into product suites."

About the Author

David Ramel is an editor and writer at Converge 360.