News

Report: Enterprise Mobility Focus Shifts to ROI

- By David Ramel

- April 26, 2017

As enterprise mobility initiatives mature, their focus is increasingly shifting to boosting the bottom line, concludes a new report from Mobile Application Management (MAM) specialist Apperian.

Also, security remains a primary concern, and more companies are struggling while dealing with mobile complexity and non-managed bring-your-own-device (BYOD) issues, according to the "2017 Executive Enterprise Mobility" report (free download upon providing contact info) conducted by CITO Research for Apperian, which earlier this year was acquired by Arxan Technologies.

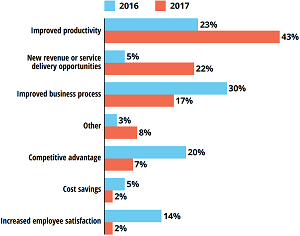

The increasing focus on bottom-line revenue returns is revealed by companies listing the primary goal of their enterprise mobility programs. While "improved productivity" remains No. 1 (listed by 43 percent of respondents) -- and actually increased by 20 percentage points from the 2016 survey -- 22 percent of respondents listed "new revenue or service delivery opportunities," compared to just 5 percent in last year's survey (this is the fourth consecutive yearly report).

"We believe this suggests that enterprises want to see mobility drive real bottom-line impact versus simply improving processes," the report said. "When digging into the details of which apps some of those mobility projects are delivering, it becomes clear that enterprise mobility is being seen as a true change-agent, enabling companies to innovate. There was a notable reduction in the number of respondents reporting mobility goals tied to employee satisfaction, improved business processes and competitive advantage."

[Click on image for larger view.]

"What is the primary goal of your enterprise mobility programs?" (source: Apperian/CITO Research)

[Click on image for larger view.]

"What is the primary goal of your enterprise mobility programs?" (source: Apperian/CITO Research)

While "improved productivity and new revenue or service delivery opportunities" goals saw percentage increases of 20 percent and 17 percent, respectively, at the other end of the spectrum were the goals of "competitive advantage" and "improved business processes," which decreased by 14 percent and 13 percent, respectively.

"These results speak to a recurring theme of increased maturity," the report said. "Mobility projects were typically initiated by IT in response to demand from employees, but as mobility programs have matured, their goals have shifted from foundational goals to bottom-line business objectives. The largest year over year percent decrease was in competitive advantage, which may suggest that organizations that have reached this level of maturity see enterprise mobility as widely adopted. In that case, organizations that still don’t have a mobility program in place are at even more of a competitive disadvantage."

Other highlights of the report include:

- Continued expansion of mobile apps: 80 percent of those surveyed state they plan to expand their app portfolio over the next 12 months.

- Variety in app portfolios: 85 percent of individuals believe their organization will be most impacted by a combination of apps that improve productivity company-wide, in addition to apps that enable mobile sales and field service.

- Security concerns remain top of mind: 57 percent of respondents are concerned about corporate data on personal and other non-managed devices. This concern is on the rise, up 13 percent from last year.

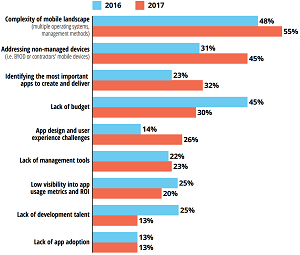

- Addressing non-managed devices: 45 percent of those surveyed are concerned about addressing BYOD, contracted workers or other users in the extended enterprise -- a 14 percent increase over 2016.

- Identifying the most important apps for users: 33 percent of respondents find it challenging to identify the most important apps to create next, those that would deliver most value to users.

[Click on image for larger view.]

"What challenges are you facing related to mobility?" (source: Apperian/CITO Research)

[Click on image for larger view.]

"What challenges are you facing related to mobility?" (source: Apperian/CITO Research)

On the security front -- almost always the No. 1 concern or "pain point" in surveys of this type -- this year's survey shows "corporate data on personal and other non-managed mobile devices" vaulted into first place by being listed by 57 percent of respondents (compared to last year's 44 percent). That puts it ahead of last year's top concern, "compromised mobile devices," which went from being listed by 60 percent of respondents last year to 49 percent this year.

That speaks to the industry's long-running BYOD problem. For example, when asked "What challenges are you facing related to mobility?" 45 percent of respondents said it was "addressing non-managed devices," up from 31 percent last year.

However, the No. 1 challenge both last year and this year was "complexity of the mobile landscape (multiple operating systems, management methods)," listed by 48 percent of respondents last year and 55 percent this year.

After touching on subjects such as the scale and scope of enterprise mobility and how it's driven, measured and improved, the report came up with five recommendations for companies concerning their enterprise mobility initiatives:

- Build on maturity by scaling your programs in both breadth and speed.

- Determine the "market penetration" for your custom apps.

- Involve users in app development.

- Contain complexity and maximize flexibility.

- Create a pipeline of great app ideas.

"The increasing sophistication of, and expectations for, enterprise mobility efforts is becoming clear," said Apperian exec Mark Lorion in a statement last week. "This year's research findings show that executives now see enterprise mobility as a key enabler in new revenue and service delivery opportunities for their organizations. Not only are mobility programs becoming more strategic, but they also are increasing in reach. Enterprise apps are now deployed to much broader communities of users, extending well beyond traditional full-time workers."

Survey data was culled from a survey of more than 100 mobility workers across 10 industries.

About the Author

David Ramel is an editor and writer at Converge 360.