News

Analysts Sort Out Low-Code Mobile Development Platforms

- By David Ramel

- March 28, 2017

Low-code development platforms are a hot topic in the dev tools space now, as dozens of vendors have stepped up to the plate to address the chronic shortage of trained developers and insatiable demand for enterprise apps.

It's so hot, in fact, that Forrester Research Inc. has followed up its Q2 2016 Forrester Wave report on low-code development platforms with a new study, this one with a mobile app focus.

In the age of enterprise mobility and mobile-first initiatives, the factors that contributed to the rise of general low-code dev platforms -- the aforementioned supply-and-demand pressures -- are magnified in the mobile space.

Experienced and trained mobile coders are so hard to find and are thus commanding such high salaries that the position of mobile app developer was recently named the "best job in America" by mainstream publication CNNMoney.

In view of such factors, Forrester updated its low-code research with a focus on mobile-centric offerings.

"These products go beyond general-purpose low-code development platforms by including features closely associated with mobile infrastructure services platforms or mobile middleware products, including support for mobile notifications, enterprise mobile management tools, and support for offline caching and filtering of data when devices aren't connected," said the new report, "The Forrester Wave: Mobile Low-Code Development Platforms, Q1 2017."

The following Google Trends graph speaks to the growing popularity of the term "low-code":

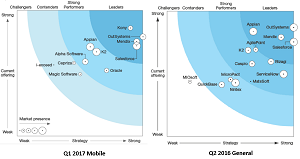

The new report covering the 11 "most significant" vendors features many of the same players, with OutSystems, Kony, Mendix and Salesforce leading the pack. Except for Kony, those were the same pack leaders mentioned in the Q2 2016 report, which featured Appian instead of Kony.

[Click on image for larger view.]

Forrester Wave Low-Code Reports (source: Forrester Research, via OutSystems)

[Click on image for larger view.]

Forrester Wave Low-Code Reports (source: Forrester Research, via OutSystems)

"The market for mobile low-code development platforms is growing because more aspiring, semiprofessional and professional developers use them to close the gap between demand for mobile apps and the talent available to create them," Forrester said in the new report. "Tools must support a variety of mobile workloads, as well as developers with varying skill levels."

Those workloads -- beyond the typical use case of an aspiring or semiprofessional developer-type seeking to enact an idea when no pros are available to do it -- include:

- Mobile-enabling existing business processes, such as field or plant inspections, expense approvals and so on.

- Creating interactive reports or dashboards, for an example use case such as using notifications to provide status information to the correct people, who can then use a mobile device to inspect glanceable information.

- Replacing pen and paper with dynamic forms that provide interactive experiences -- perhaps guided by chatbots -- to do things like collect data.

As far as serving developers with varying skill levels, Forrester said these include:

- Aspiring developers, who might be well versed in using Microsoft Excel or PowerPoint but require highly prescriptive tools that abstract away programming complexity and feature rich what-you-see-is-what-you-get (WYSIWYG) editors and the ability to easily wire up events and controls.

- Semiprofessional developers, who, though not classically trained, have development experience -- such as business process professionals, business analysts, apps pros and programming boot camp graduates.

- Professionals, classically trained and comfortable with higher-level technologies, who might use low-code tools as a force multiplier to meet strong demand for apps.

Weighing the criteria involved with supporting multiple workloads and different developer types, Forrester analyst Jeffrey S. Hammond and associates chose OutSystems to lead their vendor profiles. OutSystems placed at the top of the "market presence" index in the Wave plot and trailed only Kony on the "current offering" index.

Strengths of the OutSystems 10 platform, Forrester said, include broad features and tools for database access, integration with other technologies and collaboration functionality combined with extensive mobile features.

"Customers will find few gaps that require them to code, even when working on integration and custom user experiences -- the usual trouble spots for low-code platforms," Forrester said. "OutSystems makes it free and easy for customers to get started with its platform. Customer references like the easy maintainability of the apps they've created, and they also like the ability to use a wider range of developer skillsets to build mobile apps."

The main weakness of the platform -- in both the Q2 2016 and Q1 2017 reports -- is a reliance on third parties to provide advanced cloud-security certifications.

Meanwhile, Kony -- No. 1 in the "current offering" evaluation -- is known for its Visualizer tool introduced in 2015 for designers and subsequently pivoted to provide actual app coding, letting low-coders create native, hybrid or mobile Web apps with a declarative WYSIWYG editor that enables fast dynamic prototyping and instant app previews.

"Visualizer is a good match for developers who want to build high-fidelity, consumer-facing apps, since coders have extensive control of branding and deployment of the apps they create with it," Forrester said. "Visualizer borrows features from its professional developer cousin, Kony MobileFabric, to provide strong integration support with connectors for Oracle and SAP, as well as good support for notifications, marketing campaigns, and integrated customer feedback."

Limited support for declarative business process tools, along with limited readily available cognitive services, were listed as the platform's biggest gaps.

The order of the remaining vendors examined by Forrester is: Mendix and Salesforce grouped among the "leaders"; K2, Appian, Oracle and Alpha Software grouped as "strong performers"; and Capriza, Magic Software, and i-exceed, listed as "contenders."

For comparison, the Q2 2016 report on general -- not mobile specifically -- offerings, said: "Forrester's research uncovered a market in which OutSystems, Appian, Mendix and Salesforce lead. AgilePoint is on the boundary between Leader and Strong Performer. K2, Bizagi, Caspio, ServiceNow and MatsSoft offer competitive options. MicroPact, Nintex, QuickBase and MIOsoft lag behind."

Forrester cautions that its Wave report should only be used as a starting point in investigating prospective low-code vendors.

About the Author

David Ramel is an editor and writer at Converge 360.