News

Amazon Woos Mobile Developers Ahead of Smartphone Launch

- By David Ramel

- June 17, 2014

Just before the expected launch of an Amazon smartphone, the company sought to attract mobile developers to its platform by reporting strong Appstore growth and app monetization opportunities.

"Amazon Appstore selection has nearly tripled in the past year and developers continue to report strong monetization from the apps they offer in the store," read the first sentence of a news release yesterday.

To back up its enticing claims, Amazon provided results of recent company-sponsored research conducted by IDC that indicated "developers building apps and games for Kindle Fire are making at least as much money (often more) on the Kindle Fire platform as on any other mobile platform."

The Kindle runs on a modified version of the Google Android OS.

Though not officially announced, the industry widely expects Amazon.com Inc. to launch an Android-based smartphone at an event tomorrow in Seattle. According to an Wall Street Journal article, AT&T will be the exclusive carrier for the device, rumored to sport a hologram-like 3D capability in order "to distinguish its phone in a crowded market."

[Click on image for larger view.]

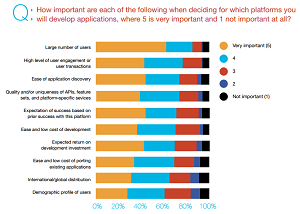

Why Developers Target Specific Platforms (source: Amazon.com Inc.)

[Click on image for larger view.]

Why Developers Target Specific Platforms (source: Amazon.com Inc.)

The lucrative mobile app store market is also crowded. Though Amazon noted the tripling of its Appstore offerings to more than 240,000 apps in the past year, that number still pales in comparison to industry leaders. Apple Inc. and Google Inc. reportedly both offer more than 1.2 million apps on each company's respective iOS-based App Store and Android-based Google Play respositories.

To boost its inventory, Amazon needs more developer buy-in, and to get that, it needs to show how lucrative its market could be. IDC's research does just that in a report titled, "The Case for Developing Mobile Apps for the Amazon Appstore and Kindle Fire." As the report notes, "Volume counts above all else when it comes to developers' decision criteria for targeting a platform." Volume here relates to the user base and also the number of transactions that are made on a platform.

As mentioned, Amazon can't compete on the user base, but the research report also notes, "This study suggests that high engagement levels on smaller user bases may be more lucrative for developers." The report is based on a survey of 360 smartphone and tablet app developers.

The Amazon news release showcased the following report findings:

- 65 percent of developers said that total revenue on Kindle Fire is the same or better than their experience with other platforms.

- 74 percent of the same developers said that average revenue per app/user is the same or better on Kindle Fire than on other platforms.

- 76 percent of developers indicated that the Kindle Fire platform helps them connect with new market segments -- an important indicator that the Kindle Fire platform can be a significant source of net-new business and "reach" for developers at a time when new market segments may be difficult to find on competing platforms, the study noted.

The report also noted that developer confidence in a platform is based on many criteria, including a provable record of success, revenue performance and return on investment (ROI).

"The Amazon Appstore and Kindle Fire fit this profile closely, offering a strong case for developers across most of these key prioritization criteria," the IDC report concluded. "A large user base relative to iOS or Android is a clear exception. However, developers suggest that what Amazon may lack in terms of a broad installed base of tablet users, it makes up for in Kindle Fire users' engagement and total development ROI on the platform."

The 14-page PDF report is available for download after registration.

About the Author

David Ramel is an editor and writer at Converge 360.